In this blog post, we will explore ESG data analytics, how it pertains to manufacturing, and how innovative reporting tools enhance transparency and foster trust in ESG initiatives.

What is ESG?

The acronym ESG has recently gained traction in manufacturing. It stands for Environmental, Social, and Governance, and it represents a set of criteria that measure a company’s impact and corporate responsibility in these three critical areas. Environmental, Social, and Governance factors have rapidly evolved from being a niche concern to becoming a central pillar of investment decisions and corporate strategies.

Achieving Environmental Excellence: Your guide to environmental KPIs, strategic practices, and more!

The Diverse World of ESG Ratings

ESG ratings serve as the compass by which investors, stakeholders, and organizations gauge a company’s commitment to sustainability and ethical practices. However, the landscape of both ESG scores and ratings is diverse, and different providers approach ESG assessments from varying perspectives. These distinctions often lead to divergent ratings for the same company.

Among the prominent sources of ESG ratings, you’ll find MSCI, Sustainalytics, Bloomberg, and Thomson Reuters, each offering its unique methodology and assessment criteria. While these providers share the overarching goal of evaluating ESG performance, the devil is often in the details. Factors like data sources, weightage of ESG factors and components, and the frequency of updates can all influence the final rating assigned to a company.

Benefits of Improving Your ESG Criteria

Improving your Environmental, Social, and Governance (ESG) criteria isn’t merely a matter of aligning with ethical principles—it’s a strategic move that can yield a multitude of benefits for your organization.

1. Enhanced Corporate Image

An enhanced corporate image is one of the most immediate and visible benefits of bolstering your ESG criteria. This improved image resonates strongly with both investors and consumers alike. Investors, particularly those focused on responsible investing, are increasingly inclined to allocate their funds to companies with strong ESG profiles. By demonstrating a commitment to sustainability, ethical practices, and responsible governance, your company becomes an attractive prospect for investment. This, in turn, can boost your access to capital and reduce borrowing costs.

An improved ESG image can also be a powerful differentiator on the consumer front. Modern consumers are more conscious than ever of the environmental and social impact of their choices. They’re drawn to brands that align with their values, and a robust ESG strategy can make your products or services more appealing. When consumers perceive your organization as a responsible corporate citizen, it can translate into higher customer loyalty and increased market share.

2. Higher Profitability and Lower Volatility

The correlation between strong ESG performance and financial outperformance has become increasingly evident. Numerous studies have shown that companies with superior ESG credentials tend to exhibit higher profitability and lower volatility. This isn’t just a coincidence; it results from prudent risk management and forward-thinking strategies.

Effective environmental stewardship can lead to substantial cost savings. For instance, by implementing energy-efficient measures and sustainable resource management practices, companies can significantly reduce their operational expenses. This translates into improved profit margins and, ultimately, higher profitability.

Lower volatility is another key benefit. Companies with robust ESG practices are often better equipped to weather economic downturns and unforeseen crises. They tend to have stronger risk mitigation strategies, which can shield them from sudden shocks and market fluctuations.

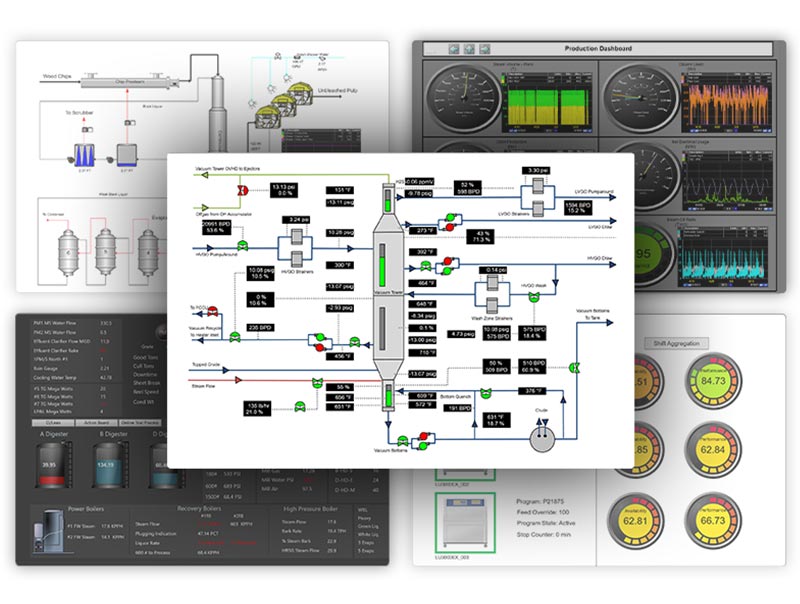

Build Real-Time Dashboards & Displays for Effective ESG Monitoring with dataPARC

3. Cost Savings on Energy Resources

Improving your ESG criteria isn’t just about appearing environmentally responsible; it’s about making tangible contributions to sustainability. One of the most immediate ways to do this is by saving money on energy resources. Energy efficiency initiatives, renewable energy adoption, and sustainable manufacturing processes not only reduce your environmental footprint but also cut operational costs.

By optimizing energy consumption, companies can enjoy substantial savings on utility bills. This improves the bottom line and contributes to a greener and more sustainable future. Moreover, as energy costs continue to rise, businesses that invest in energy-efficient technologies and practices are better positioned to thrive in an increasingly resource-constrained world.

How to Use ESG Data Analytics

In the digital age, organizations increasingly turn to specialized Environmental Management Systems (EMS) and ESG software to revolutionize their environmental data collection processes. These software solutions play a pivotal role in enhancing accuracy, efficiency, and comprehensiveness.

Create S.M.A.R.T. Goals

Incorporating ESG data analytics into your organization’s strategy begins with the formulation of SMART goals — Specific, Measurable, Achievable, Relevant, and Time-bound goals. These goals serve as the foundation for your ESG initiatives, providing clarity, direction, and a structured approach to your sustainability efforts.

Specific:

The “S” in SMART denotes that your ESG goals should be well-defined and precise. Specify the aspects of sustainability you wish to address. For example, aim to reduce carbon emissions, enhance workplace diversity, or improve supply chain transparency.

Measurable:

“M” emphasizes the need to measure your progress quantitatively. Establish key performance indicators (KPIs) that allow you to track and evaluate your ESG performance over time. For instance, you might track the percentage reduction in energy consumption or the increase in employee engagement scores.

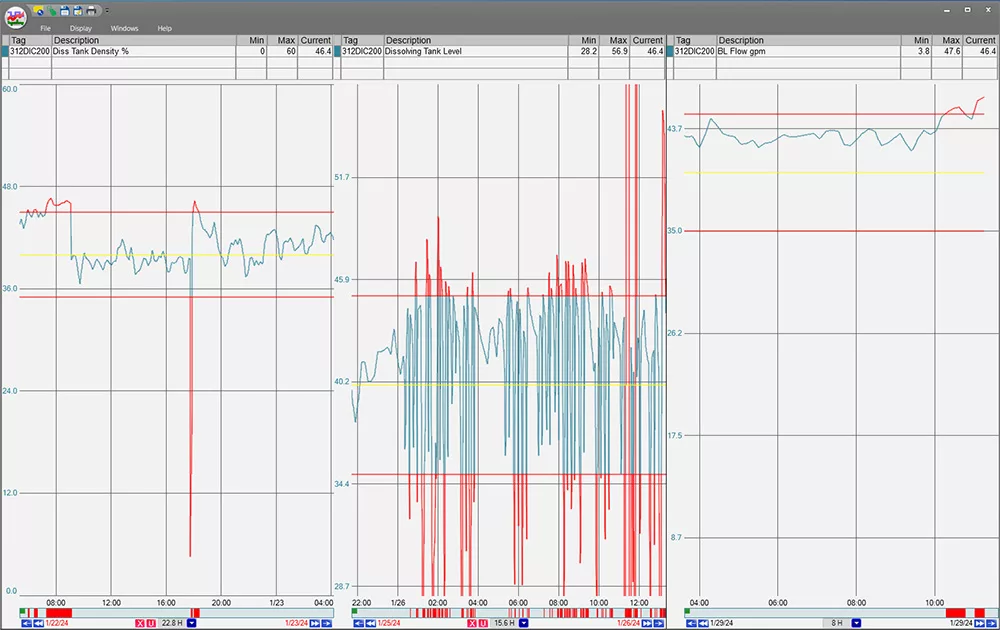

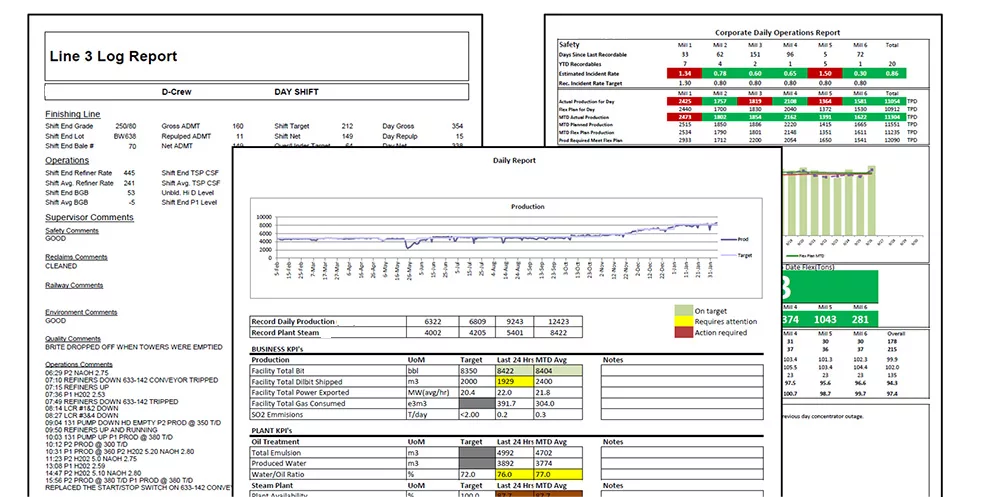

Measurable ESG data can be placed in trends like this PARCview trend and have limits and alarms applied, alerting users when key variables go beyond set parameters.

Achievable:

Goals must be realistic and attainable. While aspiring for ambitious sustainability objectives is commendable, ensure they align with your organization’s capabilities and resources. Consider the feasibility of your goals in the context of your industry and size.

Relevant:

The “R” stresses the importance of aligning your ESG goals with your organization’s broader mission, values, and stakeholder expectations. Ask yourself why these goals matter, both internally and externally. Aligning ESG objectives with your organizational purpose enhances their relevance.

Time-bound:

Lastly, “T” emphasizes setting a timeframe or deadline for achieving your ESG goals. Establishing deadlines creates a sense of urgency and accountability. Determine whether your objectives are short-term, medium-term, or long-term in nature.

Setting SMART goals for ESG data analytics is an integral step in your journey toward sustainability. These goals guide your efforts and begin the journey to numerous benefits—ranging from an enhanced corporate image to tangible cost savings—that ESG initiatives can bring to your organization.

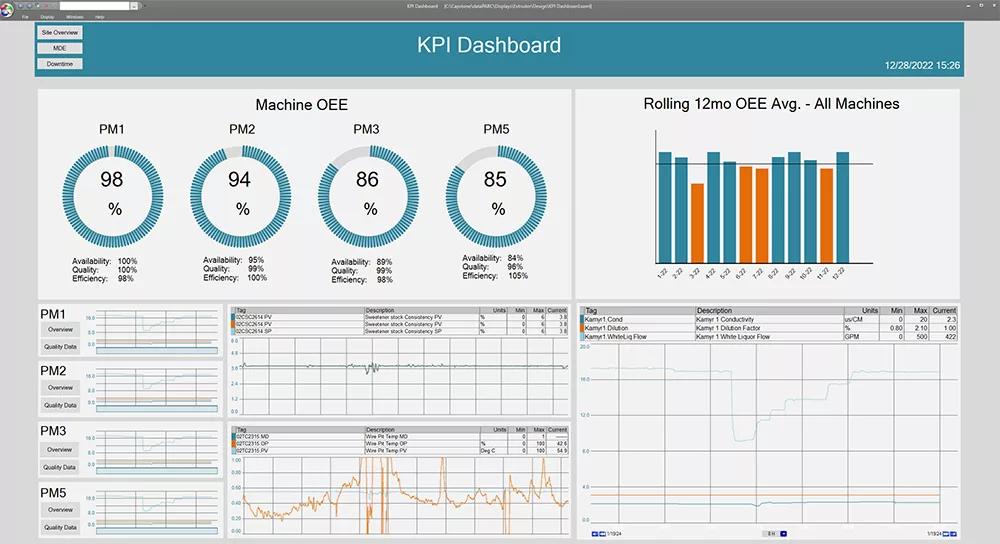

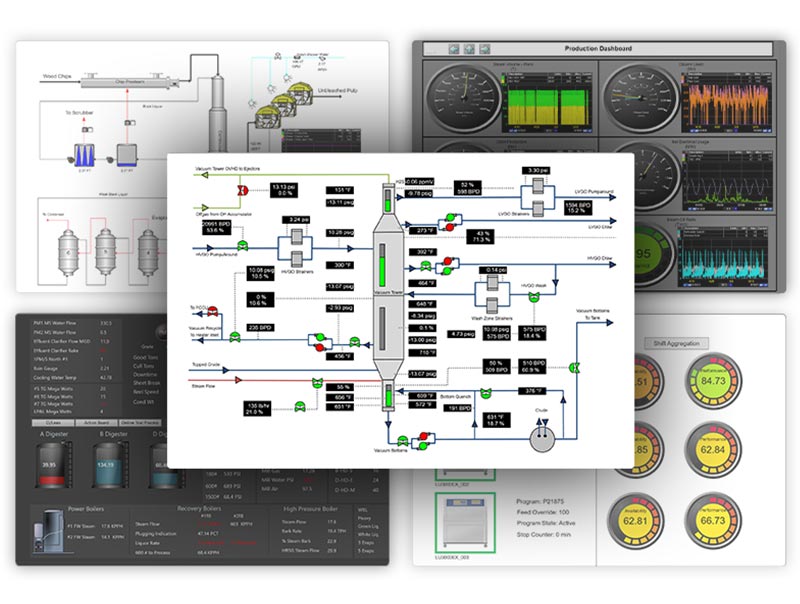

Software for ESG

Effective, ESG analysis and tracking necessitates the right tools, and software solutions play a pivotal role in this regard. Advanced manufacturing software systems, including dataPARC’s PARCview, have been purpose-built to simplify the process of gathering, analyzing, and reporting process data, especially in the realm of environmental management and reporting.

While social and governance data collection may lean toward surveys or manual entry, this wouldn’t eliminate them from being able to integrate with software like PARCview, if a company so wishes. Whichever software platform a company chooses, it must offer a centralized hub for managing diverse ESG reports and metrics, providing the following benefits:

Real-Time Alarms and Trending:

While real-time alarms and trending might not be as critical for social and governance data, which typically doesn’t exhibit hourly fluctuations, they are important for environmental metrics. Environmental data can experience rapid spikes within minutes or hours, making it imperative to have systems in place that offer alarms, notifications, and trending capabilities. This proactive approach is often the linchpin for effectively achieving the established ESG goals.

PARCview’s versatile multi-trend display can be tailored for any manufacturing metric. Each independent trend display, customizable by the number of trends, brings data to life, showcasing the real-time impact of trending insights.

Frequency of Reporting:

ESG software enables more frequent reporting beyond traditional annual disclosures. Real-time or periodic reporting ensures that your own ESG information and performance remains current and aligned with dynamic sustainability goals. Reports can be automated or configured once, and generated the same way each week, month, or as needed, saving time whenever the report is generated.

Advanced Analysis:

ESG software can automate data analysis, transforming raw metrics into actionable insights. Through data visualization, trend identification, and anomaly detection, these systems empower organizations to make informed decisions based on comprehensive ESG advanced analytics and data.

Tracking ESG Metrics

To gauge the effectiveness of your company’s sustainability and ESG efforts, diligent tracking of key metrics is paramount. This tracking process ensures accountability and is often necessary for reporting and disclosure purposes. Here, we delve into the crucial aspects of tracking environmental metrics, social metrics, and governance metrics.

Environmental Metrics:

Carbon Emissions: Measuring greenhouse gas emissions, like CO2 and methane, is critical in assessing a company’s contribution to climate change.

Water Usage: Monitoring water consumption and its sources is essential for responsible water stewardship.

Waste Management: Tracking waste generation, recycling rates, and hazardous waste disposal ensures responsible waste management practices.

dataPARC Dashboards and Graphics are customizable and can include buttons, gauges, tanks, embedded trends, or other PARCview displays.

Social Metrics:

Diversity, Equity, and Inclusion (DEI): Track diversity metrics in your workforce, ensuring fair representation and opportunities for all employees. Measure factors of employee diversity like gender, ethnicity, and age to identify areas for improvement and foster a more inclusive work environment.

Employee Engagement: Assess employee satisfaction and engagement through surveys and feedback mechanisms. Track employee retention rates and turnover to gauge the overall health of your workforce.

Customer Satisfaction: Gather customer feedback and track customer satisfaction scores. Monitoring customer sentiment helps in enhancing product quality and customer service.

Governance Metrics:

Transparency: Track transparency metrics, such as the disclosure of financial information, internal controls, and risk management practices. Transparency fosters trust among stakeholders.

Regulatory Reporting/Compliance: Ensure compliance with industry-specific regulations and standards. Track your adherence to legal requirements, environmental regulations, and ethical guidelines.

Stability in Leadership: Monitor leadership changes and governance structures within your organization. Stability in leadership is an essential indicator of effective governance.

Ways to Improve ESG

In the pursuit of enhanced ESG performance, manufacturing companies can make substantial strides by focusing on environmental, social, and governance (ESG) aspects. Here are actionable strategies to bolster your own ESG score and standing:

Build Real-Time Dashboards & Displays for Effective Process Monitoring with dataPARC

Environmental

Equipment Upgrades: Consider upgrading outdated or failing motors, pumps, and compressors to more energy-efficient models. Modern equipment often consumes less energy while delivering the same or even better performance, contributing to reduced energy costs and environmental impact.

Software Optimization: Ensure that the software systems managing your plant operations are optimized for energy efficiency. Outdated software may rely on old best practices that are less environmentally friendly.

Social

Retention/Turnover: Focus on employee retention by creating a supportive and inclusive workplace culture. High turnover rates can be costly and disruptive. Implement retention strategies to retain valuable talent.

Employee Benefits: Evaluate and improve employee benefits packages to attract and retain top talent. Competitive benefits, such as healthcare, retirement plans, and work-life balance initiatives, can enhance employee satisfaction.

Governance

Transparency: Foster a culture of transparency within your organization. Transparent governance practices build trust among stakeholders, including investors and customers. Communicate financial information, compliance efforts, and risk management strategies.

Regulatory Reporting/Compliance: Stay vigilant about regulatory compliance and reporting requirements. Regularly assess your adherence to industry-specific regulations, environmental standards, and ethical guidelines.

By implementing these strategies tailored to each ESG dimension—environmental, social, and governance—you can drive positive change, improve your ESG performance, and contribute to a more sustainable and responsible manufacturing industry.

Communicating and Reporting

Transparent and consistent communication is not just beneficial; it’s essential for ESG reporting. It’s a pivotal element that builds trust among stakeholders and demonstrates a company’s steadfast commitment to ESG principles. This is where dynamic software that integrates with other tools becomes invaluable.

dataPARC stands out as a robust tool for collecting ESG data and reporting. It’s designed to present data in a clear, comprehensive, and accessible manner. Whether you need a production dashboard, Excel Report, PowerBI Sheet, or Process Report in a PDF, dataPARC has the tools to get the data exactly how you need to see it. By leveraging such flexibility in reporting tools, companies can ensure that their stakeholders are consistently informed about their sustainability initiatives and progress.

With dataPARC, reports can be generated on a schedule and then saved in a folder or emailed to an assigned group so your data is ready when you need it.

Another key aspect of ESG communication is the integration and distribution of data, and this is where dataPARC shines. dataPARC is a versatile tool, especially for third-party integrators. It’s adept at connecting with multiple data sources, which is critical for comprehensive, high-quality ESG data reporting. This connectivity ensures that all relevant data, whether it’s about energy consumption, supply chain management, or social impact, is included in the reports.

In conclusion, tools like dataPARC are instrumental in the effective communication of ESG efforts. They not only facilitate the creation of clear and comprehensive reports but also ensure that these reports reach the intended audience. As companies continue to navigate the complexities of ESG reporting, adopting such tools can significantly enhance their transparency and engagement in ESG endeavors. The use of advanced sustainability reporting tools is not just a trend; it’s a strategic approach that can redefine how companies communicate their commitment to sustainability and social responsibility.

ESG Environmental Excellence Guide

A comprehensive guide focusing on key environmental KPIs, strategic practices, and how software can support impactful environmental strategies for sustainable operational success.